There is a free trade zone UAE or free economic zones (FEZ) in different emirates in the UAE, which give the opportunity to create a company for almost any type of activity, allowing the companies to be wholly foreign-owned. Free trade zones promote international business and provide full proprietary rights to international investors.

UAE Free Zones:

- Are regulated under the specific rules and regulations applicable to the free economic zone in question;

- These areas provide a completely tax-free regime (all activities of such companies are exempt from payment of any taxes and customs duties);

- FEZ provide a corporate tax exemption in certain cases.

There are the following types of business entities in the UAE Free Zone:

- Free Zone Establishment (FZE) – an individual shareholder.

- Free Zone Company (FZC) – 2 or more shareholders.

- Subsidiary – an affiliate of a local company or a daughter company of a foreign firm.

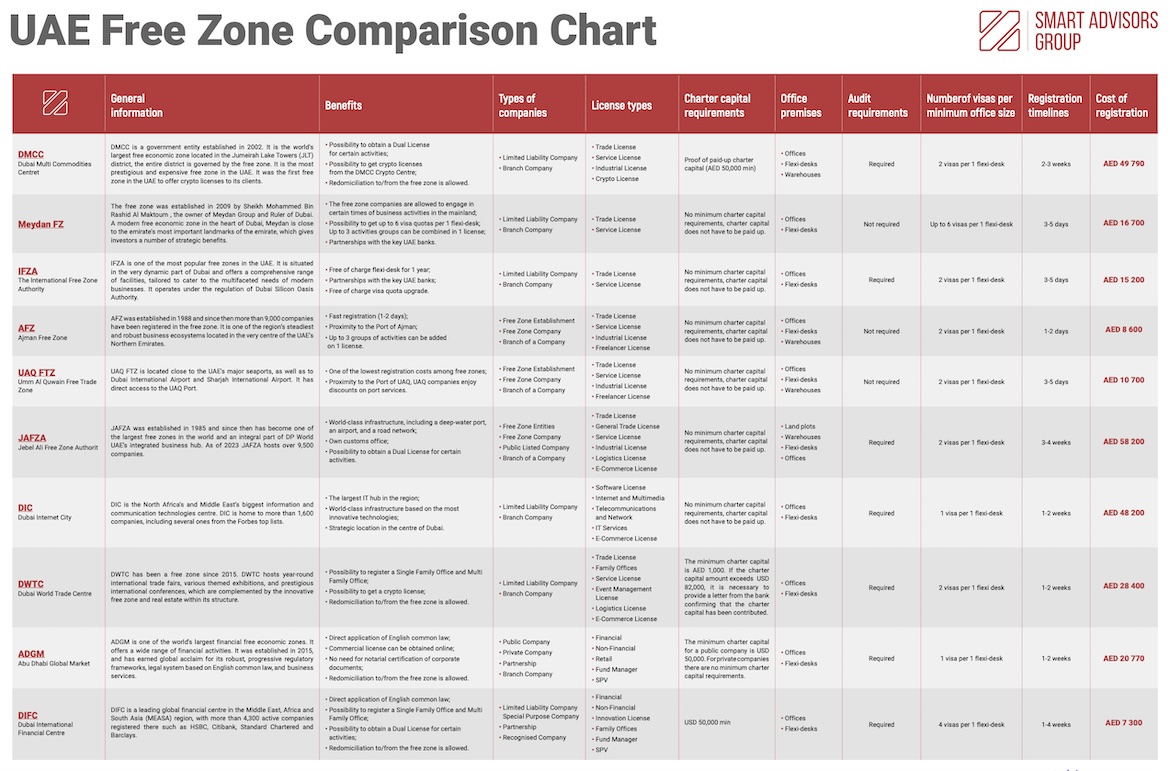

It is also possible to establish a representative office, or a branch of a company registered abroad or in one of the UAE in Free Zones. Each FEZ serves specific sectors and industries and has the right to apply its own company registration requirements.